If you live abroad, but you earned income from a Belgian source in 2021 (e.g. employee salary, statutory pension, rental income, etc.), the tax authorities might (spontaneously) send you a Non-Resident (NR) Tax Form in the next few days or weeks, depending on where you live.

The NR form is different from the standard Resident (R) form, not only because it is green instead of red, but only applies to private individuals who are tax resident in another country (who receive income taxable in Belgium). There are different types of NR taxpayers (e.g. expat, living in Belgium, living abroad, etc.), but they all have in common that the Belgian authorities expect them to pay income tax in Belgium on whatever income they generate here.

- Filing requirement?

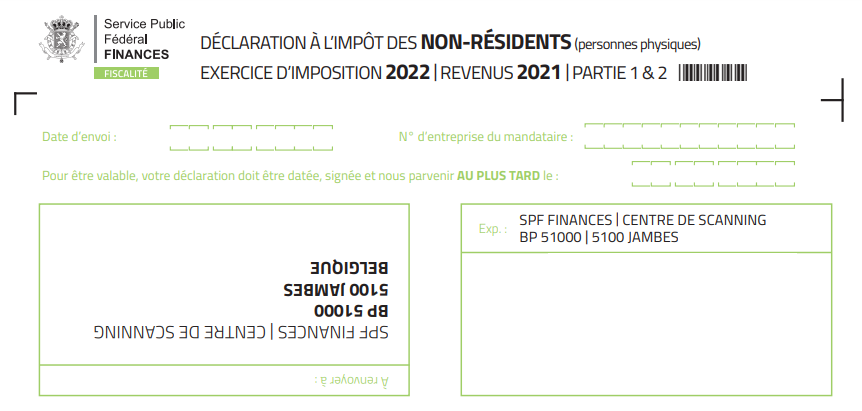

The deadline to submit the NR tax return is on 10 November 2022 if you file on paper, or by 25 November 2022 if you submit online or through a tax or accounting firm.

The fact that you have received a tax form in the mail does not necessarily mean that you will actually have to pay Belgian income tax. This depends on the type of income you received, your personal tax situation and the country where you live. In some cases, you might even get a tax refund, if Belgian tax was withheld at source before.

In recent years, we have seen a significant increase in NR forms sent out by the Belgian authorities to taxpayers living abroad. Although many did not receive anything for years (although they did receive Belgian sourced income), they were suddenly very surprised to find a blank filing form in the mailbox a few years back.

- Belgian pension

Especially, those who receive a statutory pension, survivor’s pension or a different type of public pension from Belgium, have been requested to report these earnings. Sometimes Belgian tax is already deducted at source during the year, but this is not always the case. Belgian pensions are often also simply paid out gross if the amount is relatively small. As taxpayers often report the same earnings already in the country where they live, this can potentially result in a double tax issue.

The general rule for private pensions is that they are normally taxable in the beneficiary’s country of residence. In that case, Belgium only has the right to tax if the beneficiary lives in Belgium after retirement. If you reside in another country, the latter will be authorized to tax your Belgian pension instead. In more recently negotiated tax treaties, the right to tax is often given to the source country, e.g. where the pension rights accrued or pension fund is established.

Government and civil service pensions, on the other hand, are almost always taxed at source. This rule also extends to payments made under the social security legislation of that country. For this reason, the Belgian statutory pension normally remains taxable in Belgium, even if you live in another country. Your country of residence should then normally give a tax exemption or credit for the Belgian tax paid.

- Belgian real estate

Not only beneficiaries of a Belgian pension, but also owners of a Belgian property recently came into scope of the Belgian taxman. Apart from the annual real estate tax (onroerende voorheffing/précompte immobilier), you normally only have a tax filing requirement if your Belgian property generated rental income, and only if the value of the property exceeds a certain threshold. Specific conditions apply.

For this reason, homeowners living abroad can sometimes indeed be required to file a NR tax return for their Belgian property. Whether additional income tax will be due depends on your personal tax situation and relevant tax deductions. Renovation costs, maintenance and property management fees are typically not deductible, while interest payments for a mortgage loan are.

- Belgian employment

What we have seen much less, is NR tax forms sent out to employees residing abroad but working for a Belgian employer and earning a Belgian salary. In that case, the Belgian authorities basically have all the information available to them to tax you via the payroll provider (e.g. gross salary, taxable benefits, payroll tax and social security deducted at source, etc.). In practice, we experience that the authorities do not actively pursue this category of taxpayers.

While you might not spontaneously receive a filing form in the mail in this case; it does not relieve you from your NR tax filing requirement.

- What’s next?

On their website, the Belgian authorities recommend taxpayers abroad in any case to file their NR form on time, if they received one. If you are of the opinion that you are not taxable in Belgium, the authorities suggest to still file and include a cover letter in which you further explain the reason why you think you are exempt. If you have any further questions, the authorities also explain on their website you can always (try to) get in touch with them.

If you have indeed received a NR form in the mail for income year 2021, but have no clue what to do with it, we can only recommend seeking advice from a tax professional. We can check for you if you indeed have a filing requirement. The general rule is that you are not supposed to file a NR tax return if you did not have any earnings from a Belgian source.

- An untold truth

It should be noted that if Belgian payroll (withholding) tax was deducted from your gross salary (or gross pension) during the year, the former is only an advance, which must eventually be considered for the total tax due on your total income. This is typically done by means of a tax filing followed by a tax assessment issued by the authorities within the statutory assessment period. The authorities normally have three years’ time to make the assessment. Only then the tax is definitively due by the taxpayer.

However, if the authorities fail to issue the assessment on time, the taxpayer is actually entitled to ask for a full tax refund. The withholding tax paid is part of the private assets of the taxpayer on whose earnings the withholding at source was initially made. The authorities are then legally required to refund the withholding tax to the taxpayer if they do not proceed with the tax assessment on time.

In that case, you have 5 years’ time as from the 1st of January of the year in which the withholding taxes were paid to claim your refund. For example, if taxes were deducted from your pension in income year 2018 and no tax assessment was made before 31 December 2021, you would have time to apply for a full tax refund until 31 December 2022, and this irrespective whether Belgium has the right to tax your pension according to the relevant double taxation agreement.

The withholding tax is yours in that case and can be rightfully claimed back within the legal conditions.